More businesses surcharging, but surcharging less

(17 February 2014 – Australia) A greater number of Australian merchants are applying a surcharge to their customers’ credit card payments but the average surcharge rate has remained static since June 2013, according to the latest research from industry analysts East & Partners.

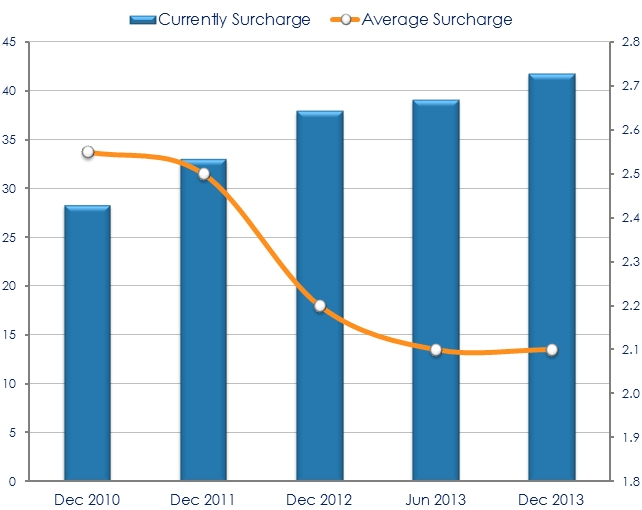

East’s bi-annual Merchants Payments report, compiled from interviews with 2247 merchants of all sizes across all states in December 2013, shows that the average surcharge being applied was at 2.1 percent, unchanged since the previous report in June but down from 2.55 percent in 2010.

The number of merchants applying a surcharge is on the rise, up from 24.5 percent in 2010 to 41.7 percent in December.

Larger Institutional sized businesses – those turning over $725 million or more – are more likely to be applying a surcharge than smaller businesses. Currently 65 percent of Institutional businesses apply a surcharge, and another 26.8 percent indicates they have intentions to do so.

In comparison, only 32.8 percent of Micro businesses – those turning over $1-5 million a year – currently apply a surcharge, although another 29.0 percent say they plan to do so.

There is little difference between the two segments’ surcharge rates, with Institutional businesses applying average surcharge of 2.1 percent, and Micro businesses an average of 2.2 percent.

Since June 2013, however, Institutional businesses have dropped their annual surcharge from 2.3 to 2.1 percent, while Micro businesses have increased their average from 2.0 to 2.2 percent.

Reforms to surcharging from the Reserve Bank of Australia are having an impact on merchant intentions to further increase surcharge levels, with a declining 9.5 percent saying they are “actively considering” an increase in the next year, down from 10.4 percent in June 2013.

Lachlan Colquhoun, Head of Markets Analysis at East & Partners, said that while the long term trend on surcharging incidence was clear, it remained to be seen just how low the surcharging rate would go.

“The research shows strong momentum for more businesses to surcharge, and soon more than nine out of ten large businesses are likely to be doing so,” said Colquhoun.

“But whether the average surcharge rate can fall through the 2.0 percent level is one of the key questions going forward.

“The RBA reforms seem to be having an impact in terms of making businesses think twice before increasing surcharge levels, but we are not seeing much evidence that they are inclined to – on average – take them much lower.

“We are in the field with the research again in June, and those results will give us some answers to this key question.”

Merchants’ Surcharging Behaviour

% of Merchants / Average Surcharge as a % of Transaction Value

Source: East & Partners Merchant Payments Program – December 2013

About the East & Partners Merchant Payments report

East & Partners Merchant Payments Markets report captures the evolving dynamics of the Australian Payments and Acquiring market through rigorous analysis of credit card surcharging behaviour, the breakdown of receivables, online payments proliferation, acceptance of payment products and merchants’ future product and technology focus.

Australian Payments Markets statistics from the Reserve Bank of Australia are also compiled yearly and integrated with trending proprietary analysis to provide a broad representation of primary drivers of merchants' current and expected behaviour and development decisions.

Business Depositor Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information or for further interview based insights from East & Partners on the Merchant Payments report, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe