Surcharging down, but not going away

(14 October 2013 – Australia) The average surcharge on credit charge transactions by Australian merchants fell to 2.11 percent in June this year from 2.22 percent a year earlier, according to research from industry analysts East & Partners.

East’s annual Merchant Payments Report interviewed 2,243 card accepting merchants, spanning micro businesses turning over A$1 million a year to large institutional merchants with revenues of more than A$725 million, and found that higher surcharges on Diners Club and AMEX transactions continue to keep the average surcharging rate above the 2 percent level.

While the average surcharge on both MasterCard and Visa transactions is 1.4 percent for both cards, merchants charge 2.7 percent on AMEX transactions and 3.3 percent on those payments made with Diners.

There is also a clear differentiation in surcharging behaviour between merchants who accept MasterCard and Visa on one hand, and AMEX and Diners on the other. 36.7 per cent and 34.2 percent respectively of merchants who accept Visa and MasterCard apply a surcharge, while the percentage for AMEX and Diners is 78.1 percent and 79.2 percent respectively.

The report found that surcharging continues to be more prevalent among non-retail merchants, where 49.4 percent of merchants apply a surcharge against 31.9 percent among retailers.

Across the market segments, larger institutional businesses are more likely to surcharge than micro businesses.

Six out of ten institutional businesses are applying a surcharge, while another three out of ten have indicated they plan to do so in the future. This compares with the micro segment, where only three out of ten businesses apply a surcharge with another three planning to do so.

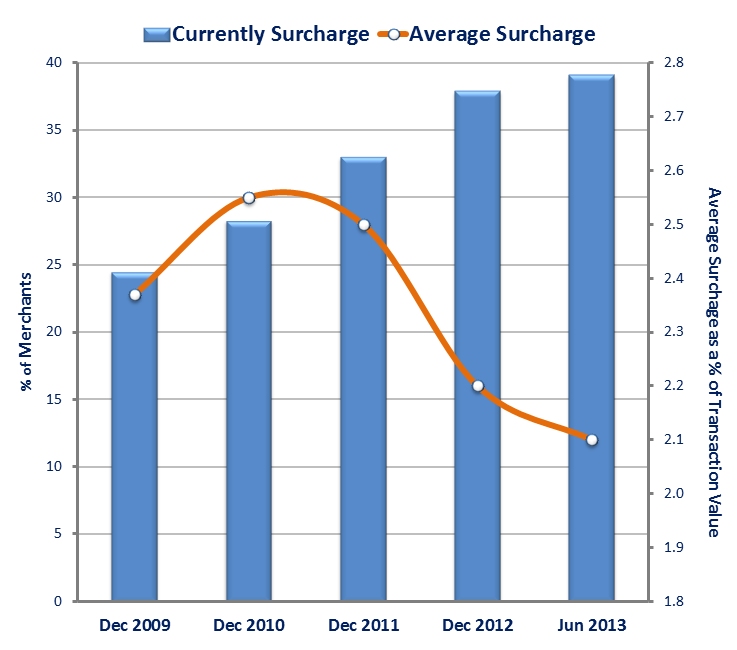

Lachlan Colquhoun, Head of Markets Analysis at East & Partners, said the research continued the trend for the number of merchants surcharging to increase, as the actual surcharging level has come down.

“In 2009, for example, 24.5 percent of merchants were applying an average surcharge of 2.37 percent,” said Colquhoun.

“In 2013, 39.1 percent of merchants are applying an average 2.11 percent.

“From this we can see that the Reserve Bank of Australia’s merchant service fee recovery based pressure on surcharging is having an impact at one level, but merchants are also more aware of their ability to surcharge and more are planning to do so.”

Merchants’ Surcharging Behaviour

About East & Partners’ Australian Merchant Payments report

The Merchant Payments report provides a deep and unique insight into key drivers of Australian merchants’ behaviour and payment practices. It draws upon East & Partners’ rich data on the payments market which has been supplemented with further reanalysis and additional primary data gathering executed directly with merchants. The report provides important market analysis across a number of critical areas including, the composition of merchant receivables, acceptance of payment products, online payments uptake, merchants’ future product priorities and credit card surcharging behaviour.

Note: Merchant Segments

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information or to interview East & Partners on this report, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe