What is the Silent COVID Recovery Killer?

(15 March 2021 – Australia) Reserve Bank of Australia (RBA) Governor Phillip Lowe highlighted in his recent speech how weak private business investment was leading into the pandemic and still is, specifically non-mining capital expenditure.

Without a significant increase in private business investment, the successfully COVID crisis “rebound” may not convert into a full scale recovery, with long term impacts for the economy.

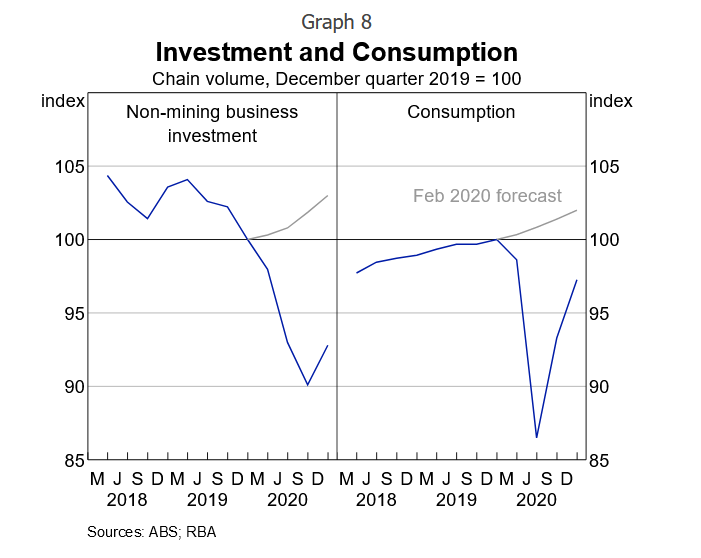

“I would like to focus on one piece of the economic recovery in Australia that has been slow to click into gear: that is, private business investment. The left-hand side of the next chart shows the RBA's forecast for non-mining business investment prepared in February last year together with the actual outcomes. The right-hand side shows the same for consumption” Mr Lowe stated.

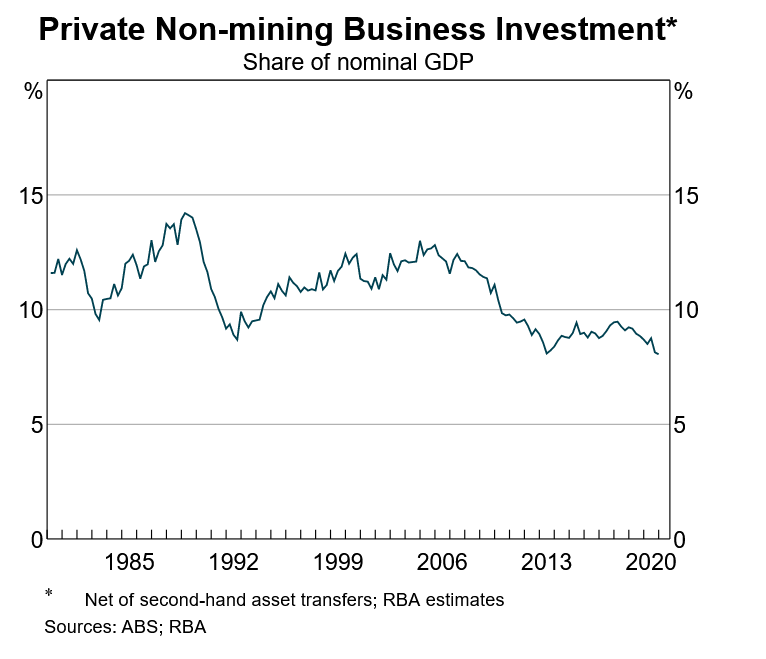

“While there was a welcome pick-up in the December quarter, particularly in machinery and equipment investment, investment is still seven percent below the level a year earlier and over ten percent below where we thought it would be at the start of last year. This weakness in business investment follows a run of years in which non-mining business investment was already low by historical standards. Since 2010, this investment ratio averaged nine percent, compared with 12 percent over the previous three decades. This is a material difference and cumulates to slower growth in Australia's capital stock, with implications for our longer-term productive capacity” Mr Lowe commented in his speech.

East & Partners latest 2021 Asset & Equipment Finance research highlights a step change in CFO and corporate treasurers behaviour towards investing for growth. Equipment finance “wallet share”, the average volume of business each customer allocates to their primary provider, has dipped again to a record low as competition intensifies.

Secondary lender engagement is most prevalent for Car and Fleet financing, a significant area of focus as volatility in second hand car prices continues to remain elevated. Equipment finance constitutes 26 percent of total borrowings on average. Interestingly primary lending account lives have lengthened modestly to 2+ years on average, increasing substantially since 2010 as the proportion of businesses with a lending relationship of less than two years steadily falls.

Does this trend confirm businesses encountering difficulty qualifying for new loans? Or greater regulatory scrutiny for vanilla debt lines as the focus turns to credit quality? A similar trend is also evident for equipment finance provider account lives, with over one in two firms maintaining their primary relationship for longer than two years.

In 2020 the government raised the instant asset write-off threshold from A$20,000 to A$30,000 and expanded the number of enterprises who could access the scheme to firms with sub A$50 million turnover. In response to the COVID-19 pandemic, institutional enterprises also gained access to the government’s instant asset write-off scheme as it seeks to ramp up business investment and employment.

How successful has the measure been so far, given awareness and uptake had been limited until now, particularly among small businesses?

In December 2020 East & Partners asked CFOs “Have Federal Government incentives such as the expanded instant write-off provision brought forward your new/replacement asset finance decisions?”

The initial response has been positive however more targeted support is clearly required. East & Partners research reveals one in two enterprises are bringing forward new purchasing decisions and acquiring new assets now while a further one in five are purchasing replacement equipment now. It is important to note significant variance exists by business size, with the latest report highlight which segments are most responsive to the initiative.

“I would like to highlight the important role that small business has in driving investment. A durable recovery from the pandemic requires a strong and sustained pick-up in business investment. Not only would this provide a needed boost to aggregate demand over the next couple of years, but it would also help build the capital stock that is needed to support future production. Stronger investment would also support a more productive workforce and a lift in both nominal and real wages” said Mr Lowe.

East & Partners reporting also captures forward dated asset finance demand. While capex reported by the Australian Bureau of Statistics (ABS) is likely to dip below A$100 billion by Q2 2021 on the current trajectory, forecast equipment finance demand is resilient.

Equipment finance volumes are forecast to expand in 2021 at a slightly stronger rate than the 2019 and 2020 forecasts. Back testing last year’s projection indicates the relatively high level of positivity expressed by businesses was not met however.

Subscribe

Subscribe