Which bank is Asia’s top FX provider? CT Census

(4 December 2019 – Asia) When it comes to managing FX, corporate treasurers need skill, nerves of steel and trusted partners according to the latest CT Census.

Treasury practitioners need a whole set of skills when it comes to managing treasury operations in each FX market. They need to be across situational foreign exchange risk, financial liquidity management, they need to develop key local contacts and they need to manage intracompany operations. Treasury professionals also need to deal with key internal issues, such as hiring and setting up staff overseas and establishing joint FX operations with companies overseas.

In terms of regulation, every foreign exchange market is unique and treasury practitioners will need a checklist of important questions. Is the local market exchange rate fixed, floating, or pegged to a specific currency? What are the pros and cons of billing in the local currency versus US dollars? As for trusted financial institutions, choosing a large global banking partner with massive reach or partnering with a nimble local bank that can cut through red tape using closer local contacts can make or break any treasury FX operation.

When it comes to tracking the performance of banks – and which financial institution to partner with – client feedback is critical.

As part of our ground-breaking Finance & Treasury Census: Asia Pacific 2019 research, conducted in partnership with East & Partners Asia, we have evaluated what matters most to the region’s corporate treasurers when it comes to FX.

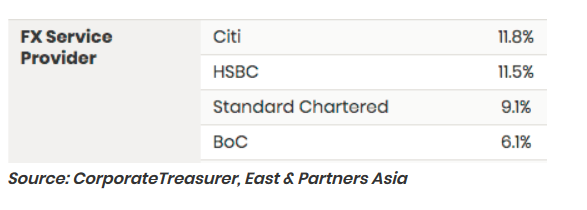

Containing more than 15,000 unique data points gleaned from interviews with more than 1200 of the most influential treasurers and CFOs from Asia’s top 100 revenue ranked companies, it covers 13 key Asia markets and 15 vital treasury and finance disciplines, including trade and supply chain finance. In terms of market share of regional FX providers, the market leaders are as follows:

SATISFACTION

In terms of satisfaction, we asked treasurers and CFOs to rank out of five the quality of the service they received from their FX provider, with one being the highest rated. What we discovered may surprise many regional treasurers.

HOW DO YOU STACK UP?

While the FX provider figures cited apply broadly to the Asia Pacific region only, the census gives a breakdown of these sectors country by country.

Our research partner, East & Partners Asia, interviewed CFOs and group treasurers for the top 100 corporates as measured by annual revenues in 13 markets.

Geographical coverage comprises: Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

PEER INTO YOUR PEERS

The data will allow treasury and finance professionals to find out how they rank against their competitors both in market share and service satisfaction.

It also provides a window on which services CFOs and treasurers prioritise and value most and allows an insight into what influences CFOs’ and treasurers’ buying decisions.

The census also contains a wealth of forward-looking data, including the key disciplines treasurers believe are most likely due a mandate change, services ripe for disruption, and the major market issues that keep them up at night.

To find out more about accessing this exclusive research, please go to: www.thecorporatetreasurer.com/census

CT’s flagship event, CT Week, is coming up next April 1-2, 2020 in Singapore. At next year’s CT Week sessions, CT will be investigating the impact of AI, blockchain and virtual banking on treasury professionals. What will it mean for security? What does it mean for manpower and hiring? CT Week 2020 brings together industry thought leaders and practitioners offering the keen insights and best practices that will guide the treasury community into the future.

Subscribe

Subscribe