A Battle of Customer Loyalty

(7 July 2014 – Asia) “Unless we are fully satisfied, we are leaving!”

This is the message from Asia’s Top 1000 institutions (ex-Japan) in East & Partners’ bi-annual Asian Transaction Banking Markets Program (ATB).

The results are based on interviews with CFOs and Treasurers from the Top 100 institutions by revenue in 10 Asian markets, and covers market share, wallet share, customer satisfaction and churn - where customers are asked if they are intending to change banking provider.

Each round, East asks the institutions how likely are they to change their primary banker in the next six months.

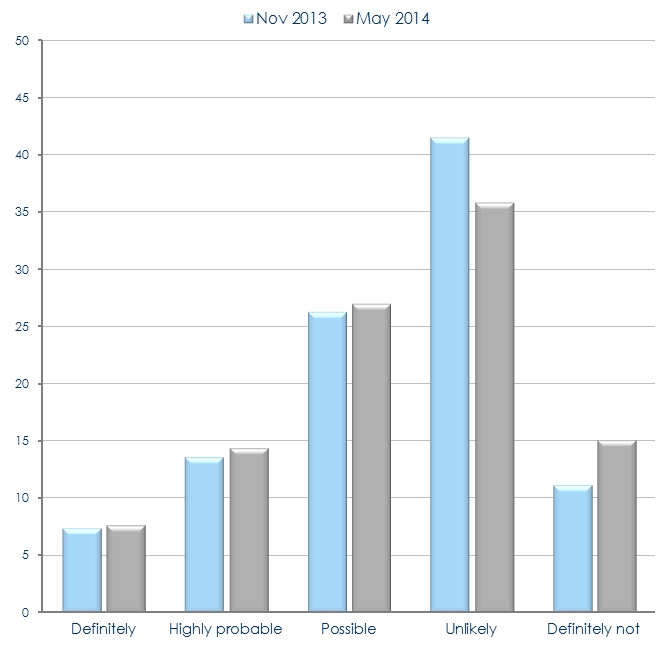

In the most recent round of research conducted in May 2014, the number of institutions saying they are “definitely” or “possibly” planning to change provider increased from 47.3 to 49.1 percent.

Unusually, at the other end of the spectrum, the percentage of institutions saying they were “definitely not” planning to move also increased, from 11.2 to 15.1 percent. At the same time, the number saying a move was “unlikely” declined.

“This pattern show a polarisation of the market’s attitudes towards their existing banking relationship into 2 main groups; those who will stay and those who would go,” said Darryl Ye, Lead Analyst at East & Partners Asia.

“The dwindling numbers for those customers that belong to the ‘unlikely’ category clearly suggest that customers are no longer satisfied with merely being satisfied with their banking relationship, signifying that they want more out of the relationship, otherwise they are planning to leave."

“The results suggest that banks are delivering to some customers and not to others, engendering loyalty on one hand and alienation on the other.”

East’s next ATB round of research is scheduled for November, when the churn intentions will be back tested against changing market share for the region’s leading banks.

The proportion of those who joined the “definitely not” category was almost twice as much as those who joined the ‘definitely moving’ category, indicating that the banks would be able to retain accounts faster than they lose it.

“There may be more to it, given that the recent trends in wallet share figures,” suggested Ye.

Likelihood of Changing Primary Banker in the Next Six Months

% of Institutions

Source: East & Partners Asian Institutional Transaction Banking Markets – May 2014

“We have observed a clear trend of increasing market share and wallet share for secondary bankers over the past few years. Perhaps to a certain extent, the secondary bankers are filling the gap left by their primary providers, hence they no longer feel the need to seek out a new primary banker to meet all of their needs”, he added.

About the Asian Institutional Transaction Banking Markets Program

The Asian Institutional Transaction Banking Markets Program analyses the Top 1,000 Institutions by revenue across Asia’s ten largest markets, excluding Japan. 36 separate service and relationship attributes are ranked by Importance and Satisfaction to reveal the ultimate drivers of Customer Churn and Mind Share accumulation. The report delivers a detailed view of the market and wallet share across primary and secondary transactional banking relationships. Understanding customers’ growth aspirations and technological innovation are captured by e-banking, Cash Management, Trade Finance and Short Term Debt metrics, enabling the identification of detailed banking relationships, service and product standards across the region.

For more information or for further interview based insights from this report, please contact:

Ms In Kai Khor

Head Client Services

East & Partners Asia

t: +65 6579 0533

m: +65 9820 3716

e: inkai.khor@eastandpartners.com

Subscribe

Subscribe