Banks Regulatory Response Taking Shape

(30 June 2014 – Australia) Australian banks are switching from deposit taking to lending in business banking markets as smaller Australian businesses continue to re-leverage post GFC.

Lower interest rates are stalling deposit growth at the same time as credit demand from businesses are on the increase, according to East & Partners Deposit Funding and Debt Index (DFDI) research.

The latest DFDI displays an expanding divide between drivers of business and retail markets in addition to disparate capital allocation priorities of larger enterprises versus small business.

With stalled business credit growth providing the first perceptible signs of recovery, closer scrutiny of deposits and loans brought about by Basel III capital adequacy requirements has already shaken up deposit funding and debt ratios noticeably.

Australia’s top 500 enterprises by turnover are depositing more into the banking system than what they borrow for the first time since DFDI reporting began in 2010. The ratio of institutional business deposit balances against lending balances has jumped from 0.47 in April 2012 to 1.01 in April 2014.

This infers institutional borrowers now deposit $1.01 for every dollar borrowed, in comparison to depositing a mere 47 cents per dollar borrowed two years ago. The adjustment gathered steam quickly in early 2014 and effectively shifts the segment from net borrower status to that of a net depositor status.

In contrast, businesses in the Micro, SME and Corporate segments are re-leveraging at a rapid pace following an extended period of paying down debt. The Micro business DFDI ratio has fallen from 2.51 to 2.09, SME from 2.46 to 1.18 and Corporate from 0.88 to 0.65.

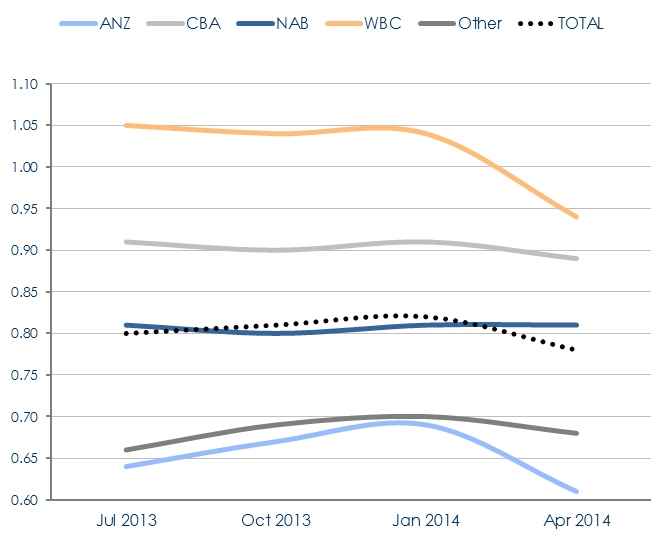

In terms of individual bank DFDI ratios the market wide average has declined by ten points since 2012 from 0.88 to 0.78. Lower DFDI ratio moves by ANZ (0.61), CBA (0.89) and NAB (0.81) have been reasonably gradual, whereas Westpac has dropped its ratio abruptly from 1.04 to 0.94 within a matter of months.

Retail markets continue to be characterised by household deleveraging, lower deposit churn as fewer consumers chase competitive rates, and a rising emphasis on residential mortgage lending growth.

“What is clear is the value of stickier term deposits gaining prominence as banks recalibrate their respective capital ratios” said Senior Markets Analyst Martin Smith.

“A shift to short tenor term deposits by small business has become increasingly prevalent, as opposed to the move to medium tenor term deposits by larger enterprises.”

“As it stands small businesses are providing the lion share of business borrowing appetite while the point at which institutional businesses reach their higher savings threshold will be closely monitored over the second half of 2014, particularly as Basel III is widely expected to push the underlying cost of bank lending higher.”

Business Deposit Balances / Business Lending Balances

Business Deposits / Business Loans

Source: East & Partners Deposit Funding & Debt Index – May 2014

About the East & Partners Deposit Funding & Debt Index

East & Partners monthly Deposit Funding and Debt Index (DFDI) provides insightful research supporting the implementation of bank funding strategies within a constrained and competitive lending market. The industry benchmarks are based on monthly deposit and lending data released by the Australian Prudential Regulation Authority (ARPA). Capturing trending data across core deposit funding and lending metrics allows unique insights to be derived, including business to retail deposit volume ratios, deposit and lending market share, rate triggers for deposit switching, deposit churn levels and tenure of term deposits.

Business Depositor Segments:

› Institutional – A$725 million plus

› Corporate – A$20-725 million

› SME – A$5-20 million

› Micro – A$1-5 million

For more information or for further interview based insights from East & Partners on this DFDI, please contact:

Jennifer Rondolo

Marketing Executive

East & Partners

t: +61 2 9004 7848

m: +61 411 395 157

e: jennifer.r@eastandpartners.com

Subscribe

Subscribe