FX Volatility Adversely Influencing Business FX Flows

(23 June 2014 – Australia) The range bound Australian Dollar has significantly influenced business FX volumes but this is unlikely to be the status quo for much longer according to new research conducted by industry analysts East & Partners.

East’s latest Business Foreign Exchange report shows a slump in business FX volumes over 2013, with the market only begin to regain momentum in the early months of 2014.

Now in its seventeenth iteration, East’s Business Foreign Exchange program provides industry wide rankings of banks, brokers and FX providers across pivotal industry benchmarks for Micro, SME and Lower Corporate business segments.

Structured by overlaying East’s' demand-side analytics upon RBA market volumes, the proprietary analysis addresses the often over looked “size of the pie” for market participants.

Total market business FX volumes have more than halved since November 2011, from A$39.9 billion to A$13.9 billion.

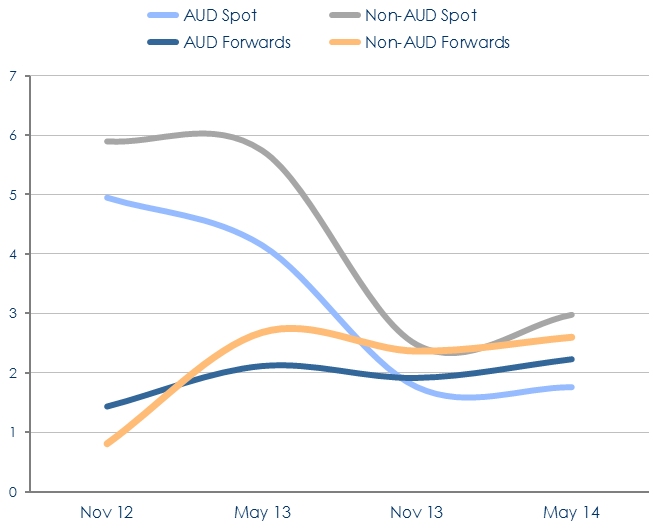

AUD Spot market volumes fell by 64.5 percent in the last 18 months, from A$4.9 billion to A$1.8 billion, whereas the AUD Forward market expanded by 55.5 percent, from A$1.4 billion to A$2.2 billion.

Broken down by business segment it is clear Spot FX usage has declined markedly, particularly among smaller businesses, while Forward FX volumes have increased by a considerable margin across all business sizes.

Non-AUD Spot FX and Forward FX markets are set to be impacted by expanding Renminbi (RMB) convertibility, with the currency now moving quickly up the rankings of the top ten most used currencies for payments globally.

Customer satisfaction ratings suggest competition is heating up for a share of dwindling overall business FX flows as banks and standalone FX provider’s ramp up their product and service propositions.

Spot FX customer satisfaction has improved market wide following an extended period of decline, reflected in deteriorating wallet share and rising customer churn.

Western Union achieves best of breed Spot FX customer satisfaction ratings among Lower Corporates, while CBA and NAB rank number one for FX Options and Forward FX respectively.

“The ongoing risk profile businesses choose to manage their cross border currency exposures is clearly defined by their uptake of FX risk solutions” said East & Partners Senior Markets Analyst Martin Smith.

“The view that short term AUD volatility will be limited by relatively stable interest rates and steadily declining commodity prices have crimped Spot FX volumes.”

“Further US, Japanese and European central bank intervention is an ever present threat to currency market volatility, and this concern is reflected in considerable Forward FX volume growth across the market.”

“The data suggests both small and large businesses, regardless of their level of FX risk management sophistication, are clearly concerned about medium to long term AUD price action.”

Business FX Volumes

A$ Billion

Source: East & Partners Business Foreign Exchange Program – May 2014

About the East & Partners Business Foreign Exchange Program

The six-monthly business foreign exchange program provides a detailed monitor of benchmarks against which FX providers can measure the success of their product and service proposition for Spot FX, FX Options and FX Forwards. This standalone report addresses FX markets across the Micro, SME and Lower Corporate segments in terms of Market Share, Wallet Share, Customer Satisfaction and Mind Share.

Business segment by annual enterprise turnover includes:

Micro Business A$1-5m annual turnover business customers

Small to Medium Enterprises (SME) A$5-20m annual turnover business customers

Lower Corporate A$20-100m annual turnover business customers

For more information or for further interview based insights from East & Partners on the Business Foreign Exchange report, please contact:

Jennifer Rondolo

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0411 395 157

e: jennifer.r@eastandpartners.com

Subscribe

Subscribe