Technology Fails to Improve Dealings with Banks

(16 June 2014 – Australia) Investments in mobile and internet banking technology by banks are not making life any easier for Australian businesses, according to new research from industry analysts East & Partners.

East’s Business Banking Index (BBI) released every two months provides an accurate monitor of customer sentiment based upon a thousand direct interviews encompassing advocacy, loyalty, satisfaction and empathy ratings of businesses for their bank.

The most recently released May 2014 report indicates advances in product offerings and the ever expanding number of mediums by which businesses can choose to interact with their business bank have not resulted in a desired uplift in business banking sentiment.

On a scale of 10 to 100 (where a rating of 10 indicates dealings are not becoming better and easier to 100 where dealings are becoming better and easier) Micro businesses declare their dealings to be the most tedious, rating Australian banks a critically low 10.7.

SMEs turning over between A$5 – 20 million per annum rated their banks a significantly higher 34.2, reporting a distinctly better ease and improvement in dealings with Australian banks compared to smaller Micro businesses turning over A$1 – 5 million per annum.

Corporate and Institutional sized businesses are more than four times more optimistic towards dealings with their bank compared to smaller businesses, rating 73.5 and 43.5 respectively.

“Despite mobile and internet banking technology enhancements, dealings with banks are seemingly not improving or becoming any easier, at least at a rate banks would be content with given the significant amount of resources devoted to improving product and service specifications” stated East & Partners Senior Markets Analyst Martin Smith.

“All business segments ratings have declined markedly over the last two years despite the sense that business banking operations have in fact become more streamlined.”

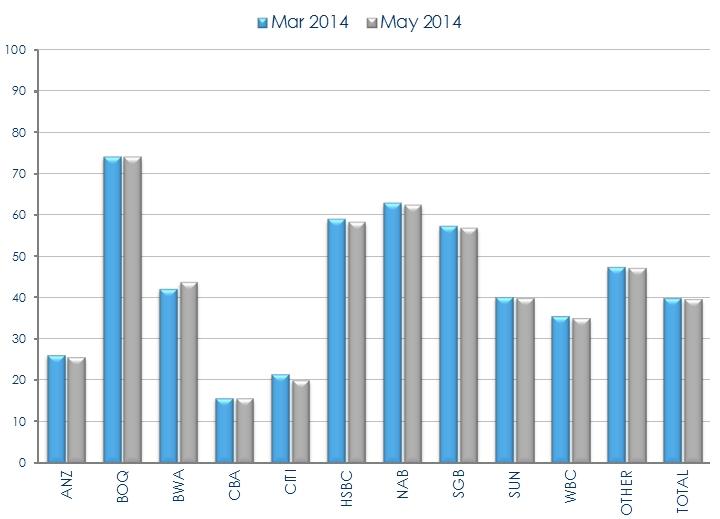

“Bank of Queensland and Suncorp have achieved the strongest improvements in customer interactions within the last two years, while NAB is performing the best among the Big Four.”

“The view that many product and service issues raised had been resolved is clearly not the case as the gap between customer expectations and performance continues to broaden.”

Ease and Improvement in Dealings by Enterprise Segment

10 (not becoming better and easier) to 100 (becoming better and easier)

Source: East & Partners Business Banking Index – May 2014

About the East & Partners Business Banking Index

The bi-monthly Business Banking Index explores the shifting preferences customers place on mind share, customer advocacy and satisfaction when ranking their sentiment towards Australian banks. The research formulates bank index scores from over a thousand interviews with Institutional, Corporate, SME and Micro businesses, effectively spanning the full range of business segments.

The breadth of the BBI analysis delivers market-spanning conclusions on how highly customers regard their bank. Bank index scores monitor key drivers of customer engagement behaviour including business banking advertising recall, mind share, loyalty, satisfaction, proactivity, empathy, detraction and advocacy.

For more information or for further interview based insights from East & Partners on the Business Banking Index, please contact:

Sian Dowling

Marcomms & Client Services

East & Partners

t: 02 9004 7848

m: 0420 583 553

e: sian.d@eastandpartners.com

Subscribe

Subscribe