Global East Analyst Meeting Insights - June 2024

(14 June 2024 – Global) East & Partners analyst meeting summary provides a unique insight into emerging research, analysis and client thought leadership trends based on the valuable “voice of treasurer”.

Following the latest releases of the Trade & Supply Chain Finance, Asset Finance and Global Business FX services, where are banks directing resources and scaling up their service offering?

What data-based insights do banks really need for informed decision making?

Business analysts describe data as “the new gold” - and for good reason. Forbes reports that businesses often find it challenging to determine the type of analytics to perform or to understand the insights derived from data,

“Companies should strive to store as much information as possible. Even if something appears useless now, it could potentially be beneficial in the future. The vast amount of data available has the potential to generate valuable insights and fuel innovation”.

On top of the boundless array of internal client benchmarks and volume flows banks meticulously sift through to better understand their customer base, coupled with secondary data sources from industry associations, regulatory bodies and central banks, what information are banks missing?

Commonly due diligence and “TAM” calculations for the “size of the pie” fall short of capturing the full magnitude of each variable influencing revenue pool analysis. Reliable primary research is essential to plug the gaps where comparable data in a style and format flexible enough to be utilised for multiple teams is unavailable.

The growing scale and complexity of data-based analysis also raises importance concerns for cybersecurity and compliance.

East’s analysts are closely reviewing long running core and custom research services to closely align the reporting to clients evolving needs, separating “common knowledge” from exclusive analysis, in particular customer forecasts and historical proof point testing. What technologies or innovations are banks implementing for businesses to use?

Defining CFOs Response to M&A Activity

What determines a corporate’s choice of cash management & payments, lending or FX provider when presented with a choice of domestic major, international, domestic non-major and challenger bank?

Following extensive restructuring by global bank majors and a heightened focus on consolidation between domestic majors in several markets, East is assessing why corporates prefer to incorporate certain banks on their panel relative to others.

What would it take from them to shift away from a domestic major to an international bank or non-major domestic?

Selling Banks to the Corporate Treasurer - New Global Insight Report Release

East & Partners' latest Global Insights Report, "Selling Banks to the Corporate Treasurer," uncovers a significant shift in transaction banking dynamics based on direct interviews with the Top 100 revenue ranked corporates in each of eight countries (N = 755) including Australia, Canada, China, Germany, Hong Kong, Singapore, United Kingdom and the USA.

The research emphasises the escalating role of corporate treasurers, who are stepping up to take the helm of decision-making responsibilities traditionally held by CFOs. The study reveals that corporate treasurers are not just ensuring operational resilience and adjusting the company's balance sheet to fund growth but are also keeping in step with developments in environmental, social, and governance matters, as well as new business investment priorities like artificial intelligence.

The readiness to switch banking provider varies significantly by region. The research found large corporates based in Hong Kong (81 percent) and Australia (78 percent) much more willing to move their business to a new transaction bank relative to Singapore corporates (62 percent). Similarly, US corporates are more willing to jump ship than their Canadian counterparts at 78 percent and 55 percent, respectively. While British treasurers are clearly standing on a “burning platform”, ready to transfer almost the entirety (90 percent) of their transaction banking wallet to a new provider compared to relatively content German corporates that display a significantly lower interest in banking away from their current provider (45 percent).

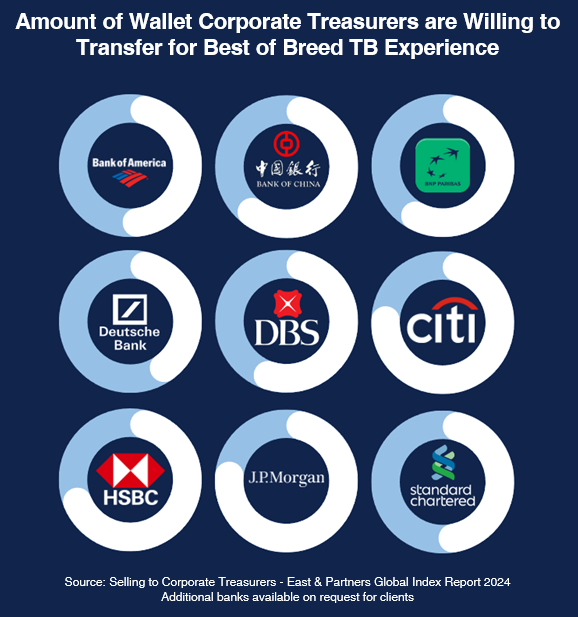

A key early gauge of customer churn is the percentage of transaction banking wallet that treasurers are willing to shift to a new provider for a best of breed experience. JPMorgan, Citi and HSBC clients are prepared to switch three quarters of their business to a new provider that makes a compelling proposition to them and can then actually deliver on that proposition. Conversely, Deutsche (44 percent), Standard Chartered (51 percent) and BofA (52 percent) clients are the most hesitant to relinquish transaction banking business to a new provider, reflecting a stronger customer retention imperative by these banks. Winning transaction banking business away from DB, SCB and BofA is infinitely more difficult than JPMorgan, Citi and HSBC who are clearly “stretched thin”.

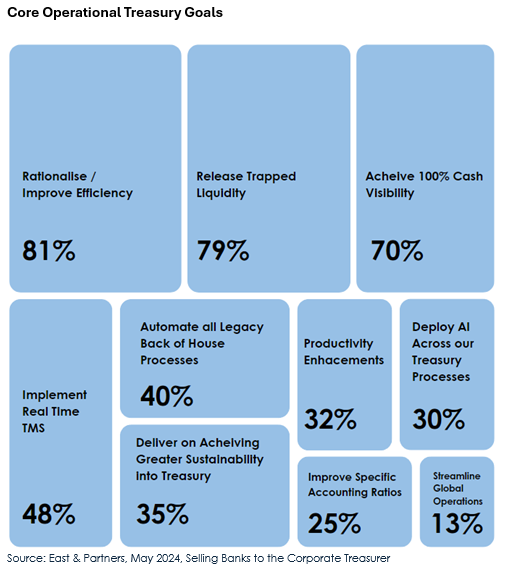

East & Partners’ Global Head of Market Analysis, Martin Smith emphasised “It always helps to align solutions with key goals and deliverables that the Corporate Treasurer has been tasked with. With this in mind, advice and offerings that work to rationalise and improve supply chain efficiencies, release trapped liquidity and achieve 100 percent cash visibility will go a long way in engaging and providing value on areas close to a corporate treasurers’ heart.”

Corporate Treasurers, emerging as the new overall owner of the banking relationships, are willing to transition a staggering 69 percent on average of their transaction banking wallet to new providers for a top-tier experience.

East & Partners’ Global Head of Market Analysis, Martin Smith, emphasised, “When a Top 100 corporate looks to make a move from their incumbent, the percent of their wallet moving lies within a tight band when looked at either by market or incumbent primary bank.”

Contact East & Partners to access the full report.

Previous Analyst Meeting Summary

In May 2024, East’s analysts were examining bullish business lending growth, the latest Global Insight Report “Selling Effectively to the Corporate Treasurer”, exclusive new cash & payments analysis, home bank effectiveness matrix and the Macro business banking outlook.

Subscribe

Subscribe